By Jake Osborne | Credit Sense & Lead Market

In the ever-changing technological landscape of fintech, the use of Digital Data Capture (DDC) has become a cornerstone for efficient and secure financial services. For some, the increase in institutions using multi-factor authentication (MFA) to improve the security of their online banking services is causing headaches, but Credit Sense stands out for reliability and innovation.

The Rise of MFA and Its Implications

The Commonwealth Bank of Australia (CBA) has recently implemented an additional layer of security for its online banking services, requiring customers to approve a prompt via the CommBank app each time an attempt is made to log on to their account via NetBank. While this move aims to bolster security, it has introduced challenges for consumers who want to share their data using consented digital data capture. The MFA process can disrupt the seamless data retrieval necessary for accurate and timely financial assessments.

See here – Commonwealth Bank Strengthens Online Security

Credit Sense: A Safe AND Seamless Solution

Amidst these challenges, Credit Sense has maintained a steadfast commitment to providing uninterrupted access to critical financial data. Our platform leverages advanced technologies and secure protocols to ensure that customers can effortlessly share their bank statement information and other supporting documents with businesses, all while maintaining security and control over their data. This approach not only enhances the customer experience but also ensures compliance with stringent security standards.

We encourage high security standards across the industry to ensure our customers can easily and safely share their data.

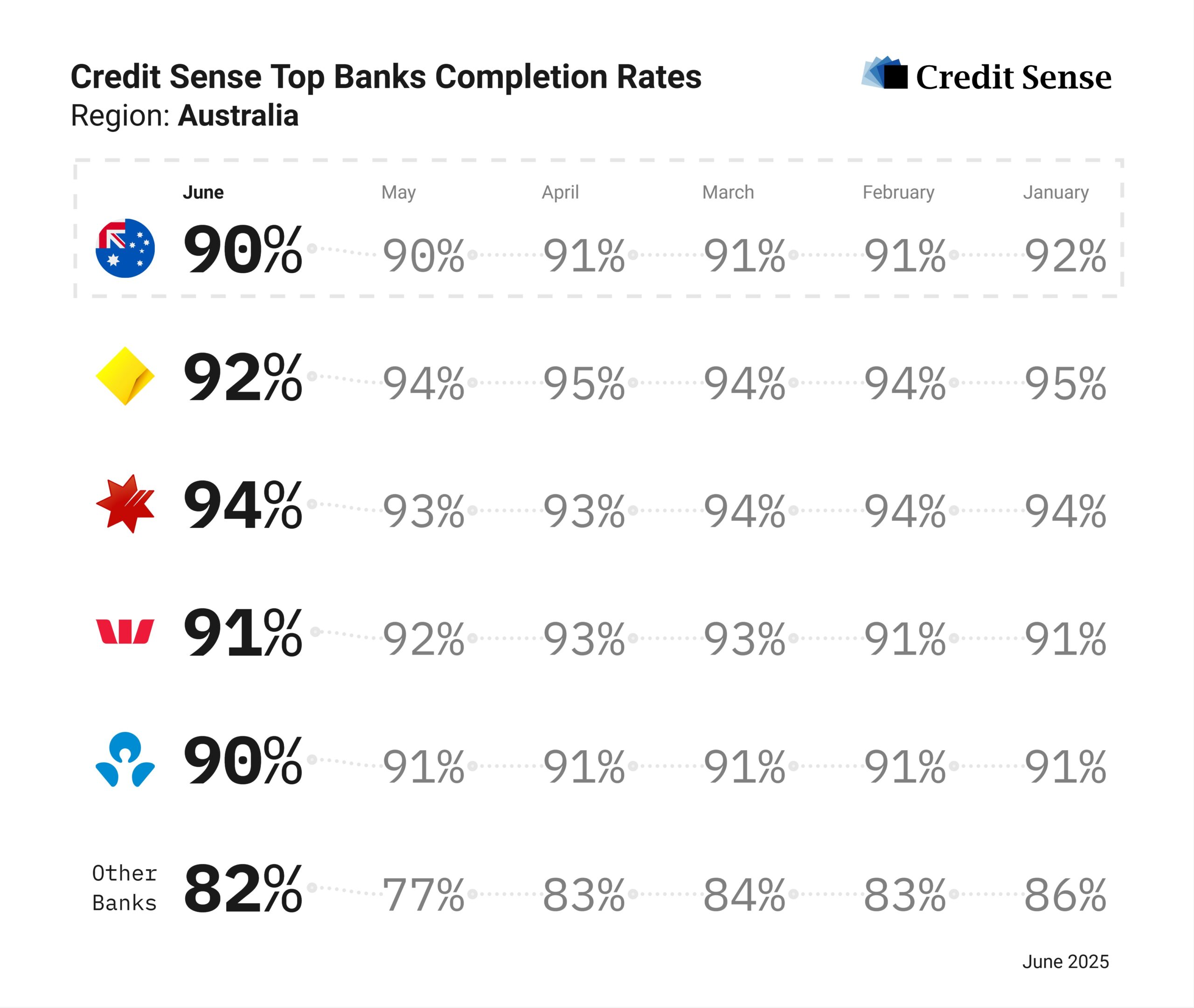

Maintaining High Completion Rates

The ability to adapt to new authentication methods without compromising service quality is paramount. Credit Sense is experienced at integrating authentication methods and committed to ensuring our partners and customers continue to experience the benefits of secure, efficient, and user-friendly data sharing solutions.

In conclusion, Credit Sense remains a reliable partner, offering secure and consistent solutions for our partners and customers. As we move forward, our focus will remain on security, innovation, and customer satisfaction, ensuring that we continue to lead in providing seamless data sharing solutions.

Credit Sense Connectivity Rates

The Practical Path to Open Banking

Yes, the time is coming to build a practical path to transition to Open Banking, and Credit Sense has a strategy that will help lenders to do just that with minimal disruption. Our aim isn’t to redesign or reinvent the wheel, but to leverage 12 years of experience with hundreds of lenders to drive CDR adoption in a way that makes sense.

Want to know more?

Reach out to [email protected] or [email protected]