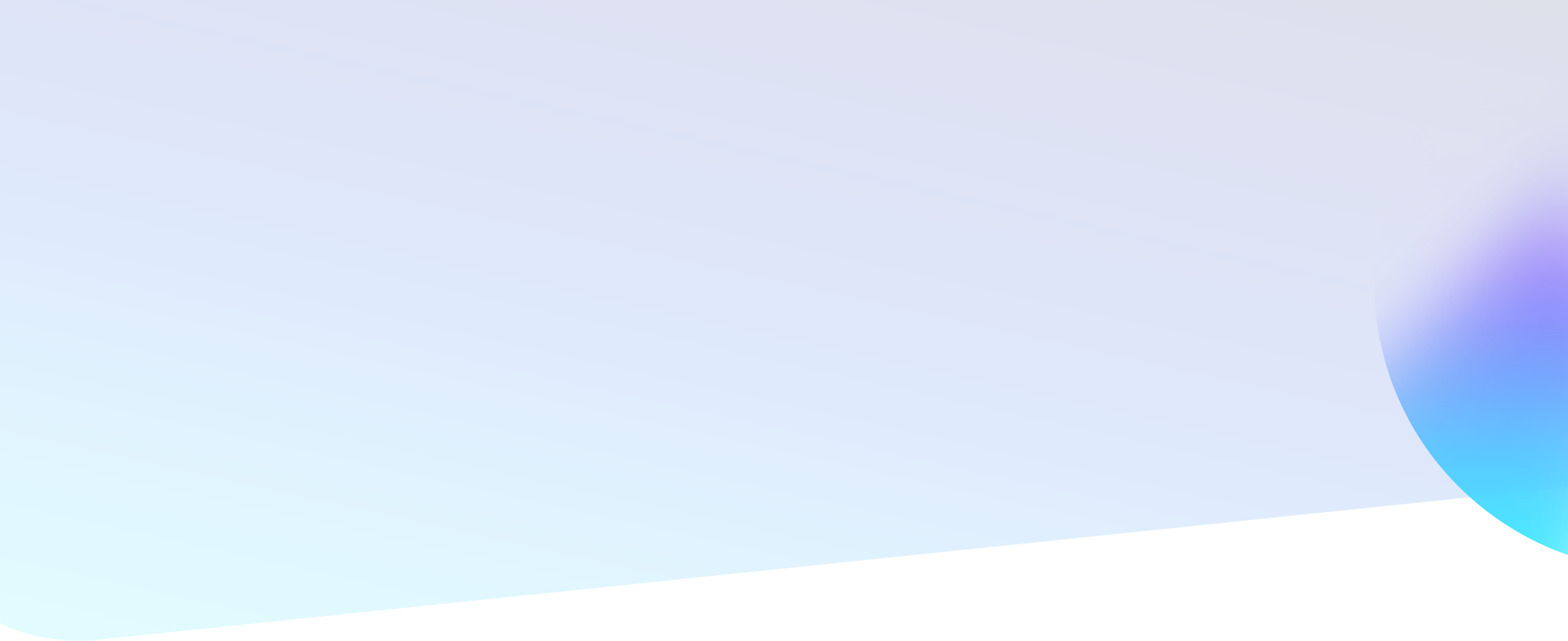

Eliminate PDF Statement bottlenecks and authenticity concerns with Credit Sense

By Jake Osborne | Credit Sense & Lead Market Managing how customers supply transaction data during credit or other applications can be complex — especially when PDF bank statements are involved. But rather than reinventing the wheel, you can now streamline the backend processing and improve the customer experience. Credit Sense’s Document Upload solution removes…

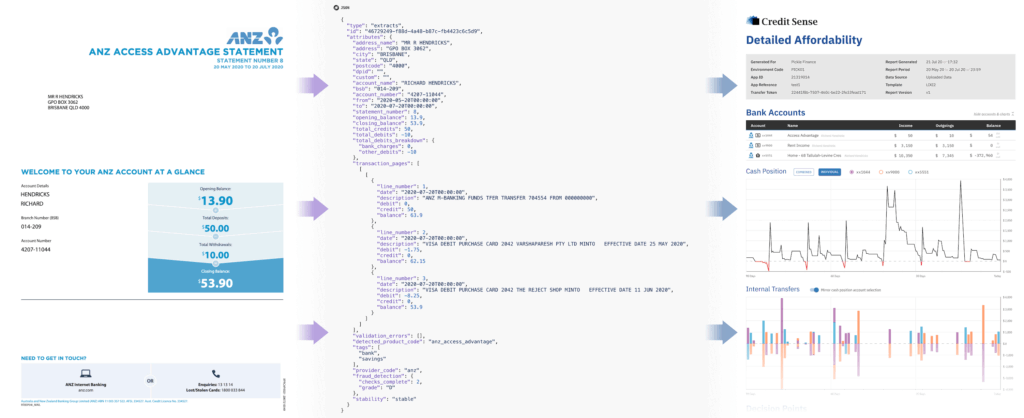

Credit Sense: Delivering high, reliable completion rates amidst increased MFA challenges

By Jake Osborne | Credit Sense & Lead Market In the ever-changing technological landscape of fintech, the use of Digital Data Capture (DDC) has become a cornerstone for efficient and secure financial services. For some, the increase in institutions using multi-factor authentication (MFA) to improve the security of their online banking services is causing headaches,…

The growing problem of poor quality finance leads and what to do about it…

By Jake Osborne | Credit Sense The Problem No One Talks About: Lead Quality You’ve invested heavily in paid media. Your cost per lead looks reasonable. The volume is flowing. But there’s a nagging issue: your leads just aren’t converting. This is one of the most common—and costly—problems facing Australian lenders, brokers, and fintechs today….