All balances are equal, but some are more equal than others

Depending on the bank, and type of account, not all balances are created equally. Banks will generally show you a current balance, which tells you how much money is in your account right now before pending transactions, and an available balance, which tells you how much money is in your account after adjusting for any pending transactions, i.e. recent transactions the bank knows about but is still processing.

But that’s not the end of the story. There are more elements to factor into the mix – like loan accounts, overdraft facilities, internet banking delays – along with your bank’s own processes and policies for managing each of these.

Validated data for better business decisions

PDF statements are a great resource when you’re assessing applications. They’re particularly valuable for giving you an accurate and reliable snapshot of an account balance at a set point in time.

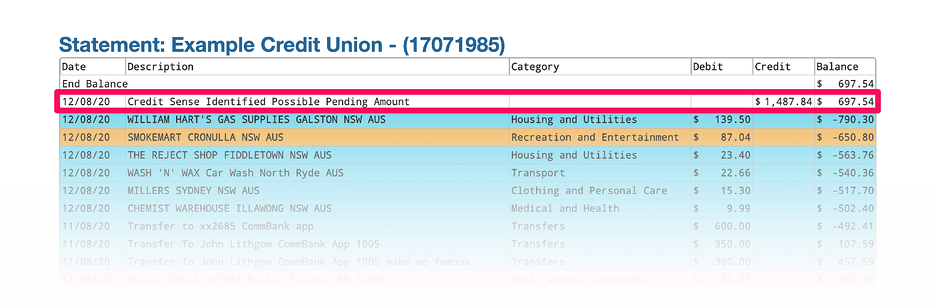

We use PDF statement information to validate the running balance on our Credit Sense reports. We identify any running balance differences between the PDF statement and the internet banking report, and display these as an aggregate possible pending amount.

Access validated balances on your reports

The good news is you can access this feature right now, across all report types in Credit Sense without any additional cost. Ask your account manager for more information about this, or any other Credit Sense products, to streamline your business intelligence.