By Jake Osborne | Credit Sense & Lead Market

The finance industry is experiencing a sharp shift in how personal and car loan leads are generated and the changes are affecting brokers and lenders across the country. Traditional marketing channels that once drove consistent results are now unstable, expensive, and less transparent than ever. For finance professionals who rely on predictable pipelines, these shifts aren’t just inconvenient, they’re costly.

At Lead Market, we offer a more stable, controlled alternative: real-time access to qualified leads that match your specific criteria. And right now, there’s a compelling case for why more control isn’t just smart, it’s essential.

The Numbers Behind the Change

Recent data shows clear, measurable shifts in lead acquisition costs and organic volatility across digital marketing channels:

- Cost-per-click (CPC) inflation in paid search is accelerating dramatically. In the 2024 WordStream benchmark report, CPC rose year-over-year for 86% of industries, with an average increase of 10%, and the Finance & Insurance category seeing especially steep drops in conversion rates of –32% (source)

- In Australia specifically, average CPC for the Finance & Insurance sector is around AUD $3.44 per click, but keywords tied to consumer loans and insurance can exceed AUD $50 per click in competitive markets (source)

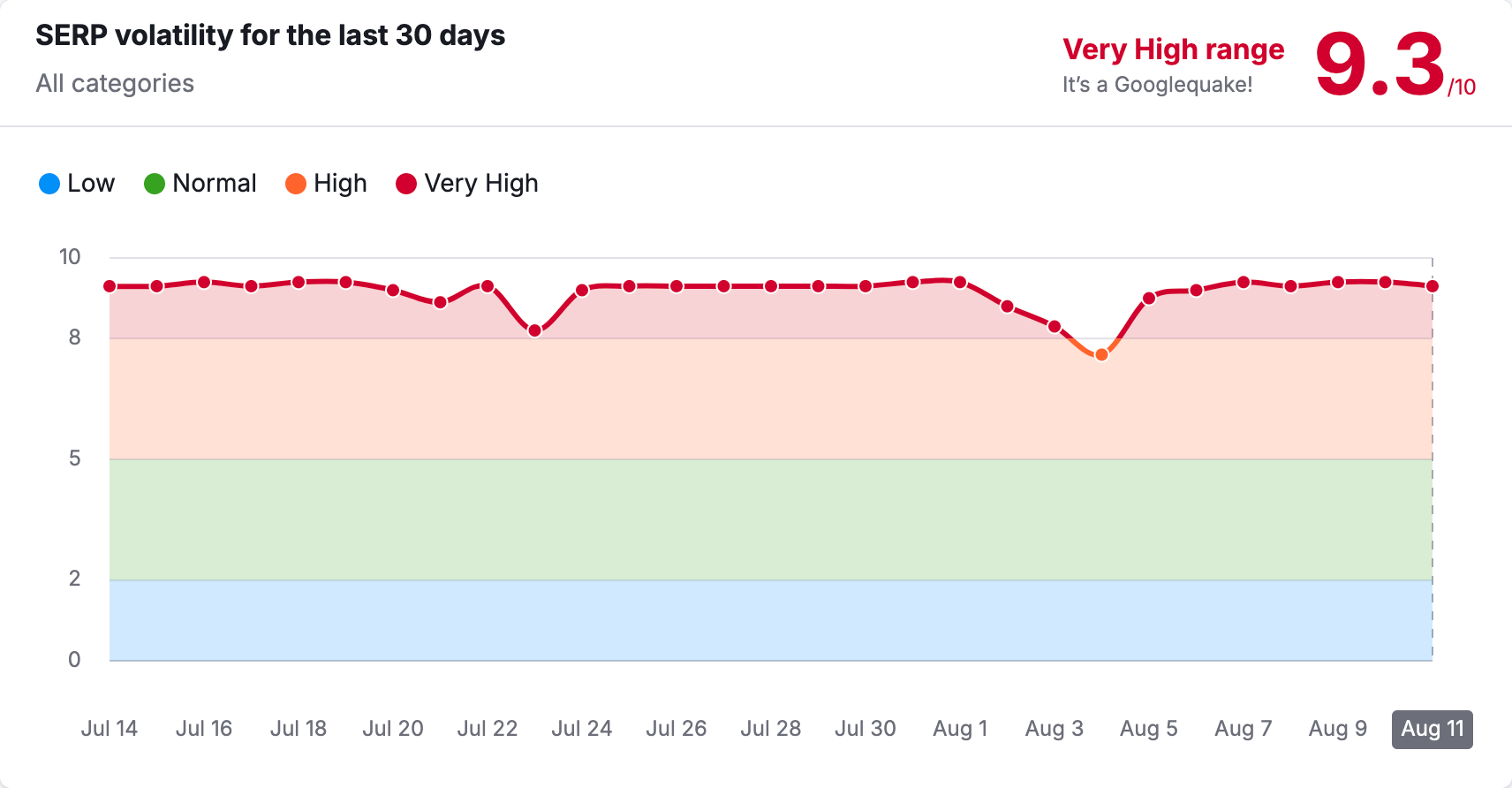

- Organic traffic volatility has spiked to multi-year highs. Semrush’s Sensor tool—which monitors daily Search Engine Results Page (SERP) ranking changes on a 0‑10 scale—routinely shows high to very high volatility (≥ 5 out of 10) across finance-related verticals, signalling that Google algorithm updates are more frequent and impactful than ever before (source)

- AI-powered search features, such as Google’s Search Generative Experience (SGE), are reducing traditional click-through opportunities by answering queries directly in the SERP, potentially shrinking organic traffic for informational keywords.

- Large-scale AI-generated content is increasing competition for rankings, making topical authority and trust signals more critical for maintaining visibility in organic search.

What’s Different This Time?

It’s not the first time digital acquisition has faced challenges, but what’s happening now is different for three key reasons:

- Platform volatility is increasing faster than marketers can adapt. Google and Meta are constantly updating algorithms and ad policies. Even with experienced media buying teams, consistency is hard to achieve.

- Compliance expectations are rising—with stricter regulation around advertising financial products, especially personal loans. The ACCC has ramped up scrutiny of misleading claims and poor-quality lead gen practices, adding new compliance layers to campaigns.

- Consumer behaviour has shifted. With more loan comparison platforms and aggregator fatigue, consumers are more selective. They’re looking for fast, direct answers—not generic ads or recycled landing pages.

AI-driven ad targeting and automated bidding are reshaping lead acquisition dynamics—improving efficiency for some advertisers while driving up competition (and costs) for high-intent audiences, making it harder to sustain ROI without advanced optimisation strategies.

Your Old Channels Don’t Work Anymore—And New Tech Takes Time

If you’re like most brokers or lending teams, your traditional lead sources—SEO, paid search, aggregator deals—just aren’t delivering like they used to. Conversion rates are down. Costs are up. And trying to pivot to new tech, AI tools, or in-house digital strategies takes time your team doesn’t have.

That’s the gap Lead Market fills.

We’re not another software platform you have to learn. We’re not an agency promising “long-term gains.” We’re a plug-and-play lead engine built specifically for brokers and lenders who need qualified leads right now—without relying on broken funnels or future-proofing strategies you haven’t implemented yet.

With Lead Market, you get:

- Immediate access to qualified personal and car loan leads

- Geo-filtering and compliance already handled

- Flexible control over volume, vertical, and targeting—no tech skills required

Your pipeline doesn’t have to suffer while you rebuild your digital strategy. Lead Market gives you ROI from day one, so you can grow now—while your team catches up later.

In short, relying on “set-and-forget” digital campaigns—or solely on SEO—is no longer a sustainable acquisition strategy. Businesses need more control over both volume and quality of their lead flow.

The Case for Direct Lead Acquisition

With Lead Market, brokers and lenders can bypass the noise and take ownership of their lead pipeline. Here’s how it works:

- You define the criteria: Set filters by loan type, amount, bank statement criteria, employment status, and more.

- You pay per qualified lead: No retainers, no ad spend.

- You scale as needed: Whether you need 5 leads per day or 50, volume is flexible and predictable.

We specialise in personal loan and car loan leads, so you’re not competing with irrelevant campaigns or sharing leads with multiple buyers. Every lead is exclusive, fully compliant, and delivered in real time.

Why Control Means Stability

In today’s market, acquisition stability doesn’t come from playing the same digital game harder—it comes from opting out of the volatility altogether. Lead Market is designed to stabilise your pipeline by removing the unpredictability of major platforms and putting the control back in your hands.

Whether you’re expanding a broker team or running a lending operation at scale, direct lead acquisition offers something few other channels can: consistency, transparency, and ROI you can actually measure.

Get in touch with [email protected] or [email protected] to discuss how we can help stabilise your lead acquisition workflow.